The Council has drawn up a draft budget for 2024/25.

This webpage gives an overview of the budget. A report was put before Cabinet on Thursday February 8 which was approved. It also contains details about the budget which will now be considered by full council on February 26.

Our services are used by most residents in Charnwood

As a reminder, here’s an overview of the services we provide:

- Recycling and refuse service

- Supporting homeless people

- Planning service including building control, economic regeneration, carbon reduction, strategic planning (Local Plan)

- Managing open spaces, Queen’s Park, Outwoods, Southfields Park, emptying dog bins, litter bins, street cleaning

- Environmental health, food safety inspections, fly-tipping, dog fouling, licensing of pubs/clubs, licensing of taxis

- Managing two cemeteries in Loughborough

- Operate Loughborough Markets and town centre events,

- Operate Loughborough Town Hall

- Operate Charnwood Museum (in conjunction with Leicestershire County Council)

- Operate three leisure centres in Loughborough, Syston and Mountsorrel

- Operate a number of car parks

- Collect Council tax, operate council tax benefits, housing benefits

- Community safety

- Support community groups with Neighbourhood Development Officers

- Operate community grants scheme

- Organise sporting activity sessions for all ages

- Operate 24-hour CCTV system with around 300 cameras across the borough and team of operators

- Operate two business centres – Ark and Oak in Loughborough and Sileby

- Organise council meetings and support 52 councillors

- Corporate support in terms of HR, finance, legal, communications, training and property services

Council housing

The general budget does not include our council housing. These are funded by tenants who pay rent.

We look after 5,500 properties and sheltered complexes and operate the 24/7 Charnwood Lifeline service.

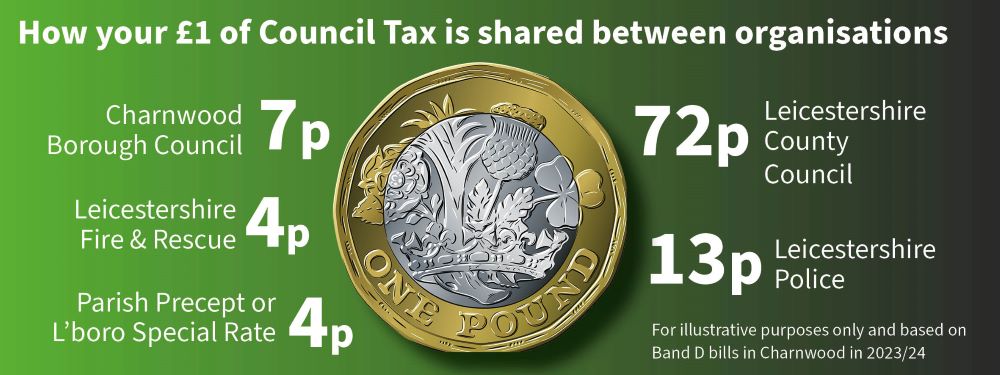

Most of your council tax goes to other organisations

Charnwood Borough Council receives around seven per cent of the average council tax bill. The rest goes to Leicestershire County Council, police, fire service and the Parish precept or Loughborough special rate.

In 2022/23, the Charnwood element of the average Band D council tax bill is £140.47 for the whole year, about seven per cent of the total bill.

People on low incomes can apply for Local Council Tax Support. This gives up to an 85% reduction on council tax bills. For example, a Band A Council Tax bill in Loughborough for 21/22 was £1,291.58 a year. Someone receiving the maximum amount of support under the Local Council Tax Support scheme would pay around £193 a year, or £3.71 a week

In 2020/21, there were over 8,300 claims for Local Council Tax Support in Charnwood, amounting to financial support worth nearly £9 million (the scheme covers the whole council tax bill, not just the Charnwood element).

Some people in extreme financial difficulties can also get further help to reduce their bill further.

Key information for the draft budget for 2024/25

The Council is planning to raise around £20.3 million from the precept for 2024/25. This is the amount required to fund our day-to-day services for the year and is after making savings and receiving income from investments, fees and charges etc.

Our sources of funding for the precept are Council Tax, income from business rates, Government grants, and the Loughborough Special Rate which is the equivalent of a parish precept in villages and paid by residents of Loughborough.

The key points of the budget for 2024/25 include:

- no use of the Working Balance reserve is projected within the draft budget

- the general borough council tax increase is restricted to three per cent (for the average Band D property, the rise would be £4.21 over 12 months giving a total of £144.68 for the year)

- the Loughborough Special Expenses council tax increase is to be set at 1.99%, in line with previous years

- a £100,000 grants pot is to be created to enable community groups working with residents struggling with the cost of living, £25,000 of which is to be specifically allocated to the Citizens Advice Bureau

- the charge for the garden waste service is being frozen for 2024/25

To note, other organisations such as Leicestershire County Council, police and fire services and town and parish councils may also decide to increase their share of council tax.

Next steps

- February 26, 2024 – Council to consider the budget for 2024/25

Last updated: Tue 20th February, 2024 @ 09:36